If you prefer to

see any doctors who accept Medicare and go to any hospitals in the US

pay a higher monthly premium and have lower out-of-pocket costs for your health care services

You may want to consider getting a Medicare Supplement Plan.

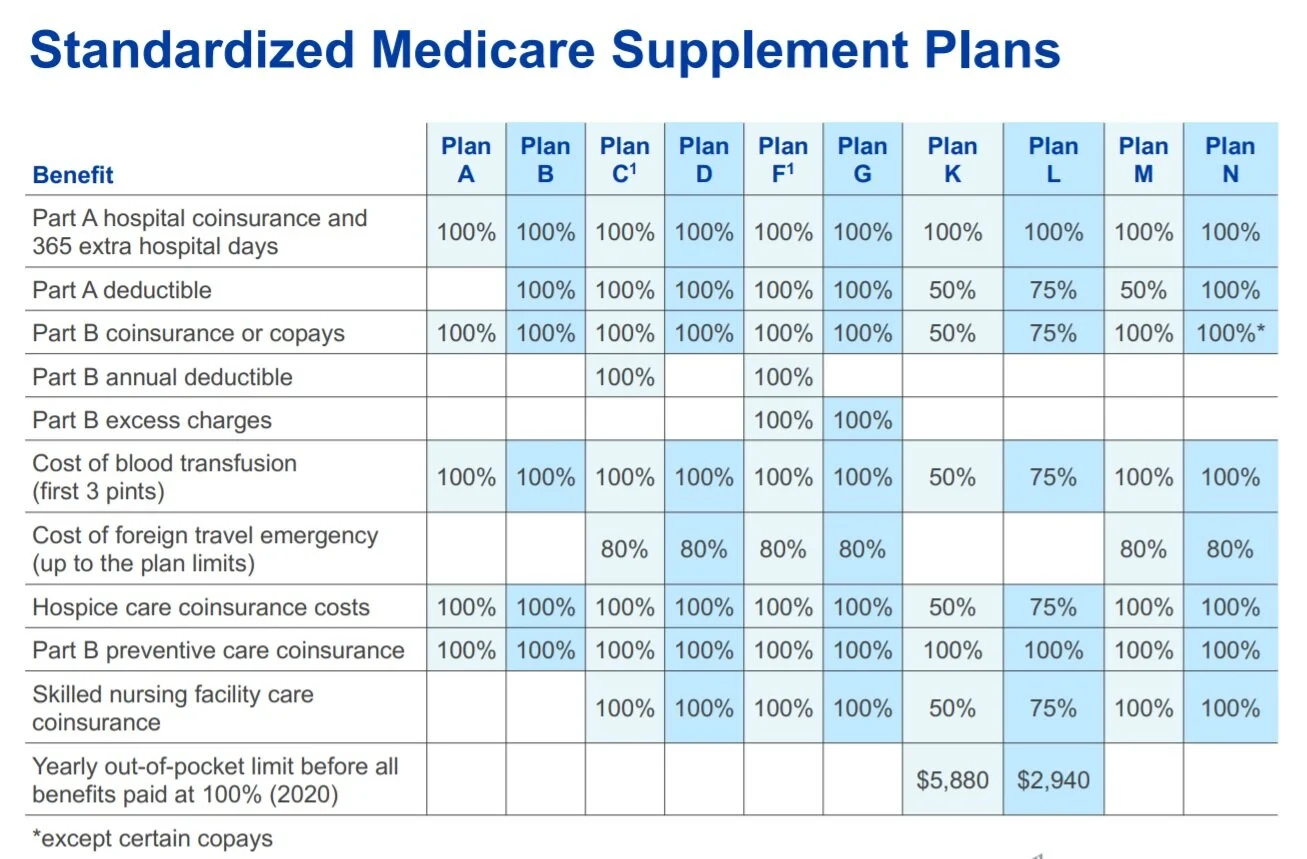

Plans may help pay:

Part A and Part B deductibles

Co-pays, co-insurance and provider excess charges

Cost for extra 365 days of hospital care after lifetime reserve days used

Cost of blood transfusions, first 3 pints

Cost of foreign travel emergency, up to plan limit

Here are different plans of Supplement with different benefits

Please note Plan F will not be available for those turning 65 on 1/1/2020 and after. For seniors who have already turned 65 prior to 1/1/2020, they can still have the option of signing up Plan F. However, medical underwriting may be required.

Plans do not help with:

Prescription drugs

Routine dental, vision or hearing care

Eye glasses, contacts, or hearing aids

Extra days in a skilled nursing facility after Part A benefit

Custodial care (help with bathing, eating, or dressing)

Long-Term care